Enhancing LP Yields on Balancer with Aura Finance

Aura Finance is a yield optimizer built on top of Balancer. It enables liquidity providers to maximize their yields in specific pools, as Aura is the largest veBAL holder. Find out more here.

Maximise your yield if you want to maximise

Aura Finance is a yield optimizer built on top of Balancer, an AMM decentralized exchange. Users provide liquidity and receive Balancer Pool Tokens (BPTs), which represent their positions in the pool. They can then stake their BPTs in Balancer Gauges to earn BAL rewards. The more BAL users have locked, the higher their yield boost (up to 2.5x).

Aura enables a social aggregation of BAL to maximize liquidity providers' yields on Balancer. All BAL staked through Aura is converted into veBAL, locked up for the maximum time. In return, users receive auraBAL, representing their ownership of the veBAL. In short, auraBAL is a liquid wrapper for veBAL.

The protocol uses this veBAL to collect Balancer protocol fees (veBAL holders receive 65% of these fees) and direct emissions to specific pools (Balancer Gauges).

The best way to provide liquidity on Balancer

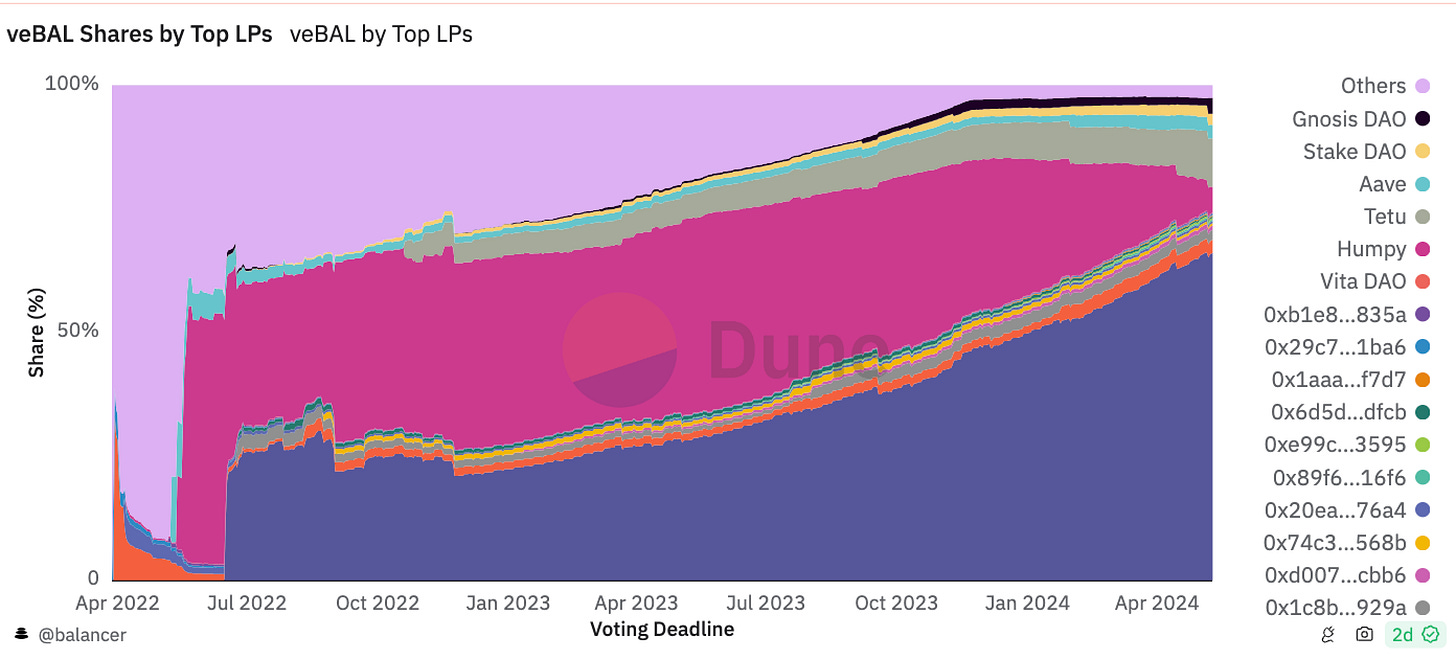

Year-to-date, Aura has grown its veBAL holdings by 32.40%, becoming the largest Balancer staker by far. Additionally, Aura holders can vote on Balancer gauges bi-weekly.

The biggest pool on Aura, rETH-WETH, has a TVL of $54.10m, making it the main liquidity provider for that pool on Balancer. Providing liquidity through Balancer typically offers an APR of 2.21%; however, using Aura increases this APR to 4.23%, including Aura incentives.

Aura simplifies the process of maximizing yield for liquidity providers on specific Balancer pools. The top pools currently are rETH/WETH, rETH/weETH, ezETH/weTH, and WETH/osETH, showcasing the popularity of LSTs and LRTs.

The protocol has been audited multiple times by reputable auditors such as Peckshield, Zellic, and Holborn. The core team also ran a Code4rena competition and placed a $1m critical bug bounty on Immunefi, demonstrating the contributors' commitment to security.

Take your LP to the next level

This seems to be due to the points meta, as users are farming LRT and EigenLayer points. Regardless of the reasons, this demonstrates demand for protocols that maximize the yield of liquidity providers.

Yield optimizers saw their TVL increase from $3.67 billion to $8.64 billion, representing a growth of approximately 135.41%. Of this, $6.95 billion is dominated by Pendle, Convex Finance, Aura Finance, Hyperlock Finance (an Aura franchise), and Coinwind.

Yield optimizers is the 3rd fastest growing DeFi category after restaking and liquid restaking. The lending vertical of LPDFi is needed more than ever to enable new strategies for this fast growing category. StableUnit enables this by allowing users of different yield optimizers to utilize their strategies with leverage, borrowing USDPro against their positions.

Imagine leveraging your Aura weETH-rETH position, which earns you LP swap fees, rETH staking rewards, weETH staking rewards, Etherfi loyalty points, EigenLayer points, AURA, and BAL incentives. Now, imagine leveraging this strategy. You don’t need to imagine anymore, get ready for StableUnit.

To stay up to date on StableUnit, follow us on Twitter and join the conversation on Telegram. You're still early, anon.